Policy and Basic Mindset

Basic Views on Corporate Governance

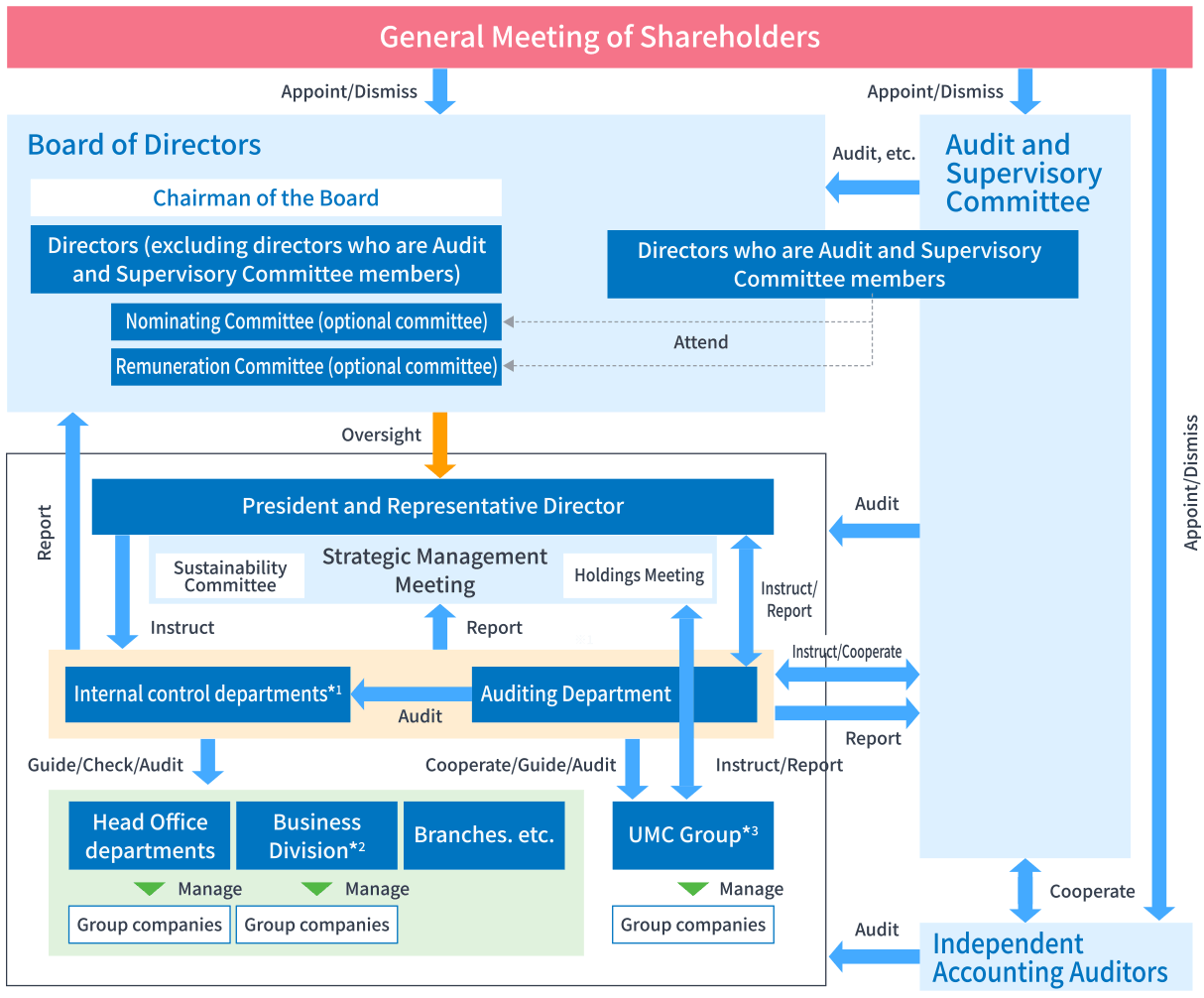

The basic mission of the UBE Group is to secure sustainable growth throughout the Group and enhance corporate value over the medium and long term. To achieve these goals, it is important to establish effective corporate governance that will enable the UBE Group to ensure the sustainability of appropriate business activities. Likewise, it is imperative that UBE fulfills its responsibilities to all stakeholders, including shareholders, customers, business partners, employees, and communities, while striving to earn their confidence. This is achieved through the establishment of a system by which directors who are Audit and Supervisory Committee members with the right to conduct audits and state opinions have voting rights at the Board of Directors. Thus, as a company with an Audit and Supervisory Committee, UBE will strive to strengthen the supervisory function of the Board of Directors over the execution of business and accelerate such execution by delegating a portion of important executive decisions to the President and Representative Director.

Going forward, UBE will continue striving to enhance corporate governance through activities that include streamlining management, increasing transparency, speeding up decision making, clarifying management responsibility, and strengthening management oversight functions.